It plays a very big part in the success of any portfolio. Mutual funds invest in a broad range of securities. This limits investment risk by reducing the effect of a possible decline in the value of any one security. Mutual fund unit-holders can benefit from diversification techniques usually available only to investors wealthy enough to buy significant positions in a wide variety of securities.

Mutual Funds

Mutual Funds are financial instruments

Our Services

Giving Ideas for your Investments.

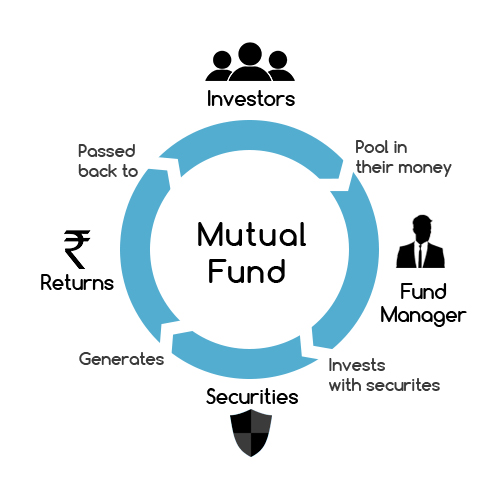

Mutual Funds are financial instruments. These funds are collective investments which gather money from different investors to invest in stocks, short-term money market financial instruments, bonds and other securities and distribute the proceeds as dividends. The Mutual Funds in India are handled by Fund Managers, also referred as the portfolio managers. The Securities Exchange Board of India regulates the Mutual Funds in India. The unit value of the Mutual Funds in India is known as net asset value per share (NAV). The NAV is calculated on the total amount of the Mutual Funds in India, by dividing it with the number of units issued and outstanding units on daily basis.

What is Systematic Investment Plan?

An investor commits to invest a specific amount for a continuous period at regular intervals, this ensures that he gets more units when prices are lower and fewer units when prices are high, this works on the principle of rupee cost averaging when invested at different levels and automatically participate in the swing of the market.

Advantages of Systematic Investment Plan:

Power of Compounding, To avail the benefit of power of compounding one has to start early and invest regularly, a delayed investment will lead to greater financial burden to meet the required goals, at early stage a less investment needed where as more investment is needed at a later stage to accumulate the same planned corpus.

Benefits Of Investing In Mutual Funds Through SIP

- Rupee Cost Averaging: The biggest advantage of SIP is that one need not time the market.

- Power of Compounding: “Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.” – Albert Einstein

- Discipline: Discipline is the key to successful investments.

- Convenience: SIP is one of the most convenient ways of investing.

- Tax Benefits: An investor can start a SIP in tax saving funds (ELSS) to avail tax benefits by saving upto 1.5 lakhs under section 80C.

Advantages of Systematic Investment Plan

SIPs give a disciplined approach to investing:

One of the major benefits of investing via SIP is that it helps in instilling the much needed investment discipline.

Convenience:

SIPs are also very convenient. Money is deducted from your Bank Account through Auto Debit Facility. Liquidity -Facility to withdraw the Invested Amount any time. Although not recommended for all times.

Minimize the risk of equity fluctuations:

As you are making periodic investment in equities you are able to ride through ups and downs of equity with ease. When the market goes up you earn fewer units and when it falls you receive more units.

Advantage of Diversification:

A major benefit of investing in Mutual Funds via SIPs is that you get the advantage of diversification even with small investments. So your risk is spread out enabling you to make most of the gains from different holdings.

Benefit of Compounding:

Since you remain invested for longer period, the investment is compounded and hence the yield goes up. Earlier you start investing in SIP, the better it is even with a small saving of Rs 1000/- and as your investment compounds over longer term it gives you an advantage of wealth creation. SIP should be done for a period of 10 to 15 Years (preferably 15 Years or more) to get full benefit of compounding.

Benefit of Rupee Cost Averaging:

It is a technique of buying fixed rupee amount of a particular investment at regular intervals, regardless of NAV. You are buying the units in all and different scenarios –Market goes up, Market goes down, Since you are buying units every month at a different NAVs, the purchase cost is averaged out.

To Know more SMS at 9910911169

Professional Financial Experts

Every Mutual Fund scheme has a well-defined objective and behind every scheme, there is a dedicated team of financial experts working in tandem with specialized investment research team. These experts diligently and judiciously study companies, their products and performance, and after thorough analysis, they decide on the best investment option most aptly suited to achieve the scheme’s objective as well as investor’s financial goals.

Diversifying Risk

Low Cost

Mutual Funds generally provide an opportunity to invest with fewer funds as compared to other avenues in the capital market. You can invest in a mutual fund with as little as Rs. 5,000 and also have the option of investing a little of Rs.500 every month in a SIP or Systematic Investment Plan.

Liquidity

You can encash your money from a mutual fund on immediate basis when compared with other forms of savings like the public provident fund or National Savings Scheme. You can withdraw or redeem money at the Net Asset Value related prices in the open-end schemes. In closed-end schemes, lock in period is mentioned, investor cannot redeem his investment until that period.

Variety of Investment

There is no shortage of variety when investing in mutual funds. There are funds that focus on blue-chip stocks, technology stocks, bonds or a mix of stocks and bonds and with due assistance from a financial expert, the investor can choose a scheme that aptly fits his requirements, and helps him achieve maximum profitability.

Kingsley is trusted by 6+ million users in 175+ countries.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Why Choose Us

Smart Investing with Smart Ideas

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Let's Work Together

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.